How to speculate in Crypto Without having Buying Cash

The simplest way to obtain financial commitment publicity to crypto without having obtaining crypto alone is to purchase stock in a firm that has a economic stake in the future of cryptocurrency or blockchain technological innovation.

But investing in particular person shares can bear similar threats as buying cryptocurrency. As an alternative to choosing and purchasing particular person stocks, specialists endorse investors set their dollars in diversified index funds or ETFs rather, with their proven file of long-term advancement in price.

“Surprisingly, most folks by using a retirement prepare or an financial investment portfolio allotted within an index fund already have some exposure to crypto,” claims Daniel Johnson, a CFP with ReFocus Economical Planning.

Lots of the finest index money — like S&P 500 or total market place cash — involve publicly traded businesses that have some involvement While using the market by both mining crypto, currently being involved with the development of blockchain technologies, or Keeping considerable amounts of crypto on their own balance sheets, states Johnson.

By way of example, Tesla — which holds over a billion dollars in Bitcoin and approved Bitcoin payments in past times — is A part of any resources that track the S&P 500. Considering that its 2020 inclusion, it’s turn out to be Just about the most important, and as a consequence influential organizations while in the index. And Coinbase, the sole publicly traded cryptocurrency Trade, is within the ARK Fintech Innovation ETF.

Even so, In case you have some extra money (and you also’re tolerant of the danger), it is possible to choose to allocate a little quantity of your portfolio to distinct businesses or even more specialized index resources or mutual resources. “An investor bullish on the future of cryptocurrency could spend money on the stocks of organizations working on that technological innovation,” says Jeremy Schneider, the non-public finance professional behind Personalized Finance Club.

Professionals generally endorse holding these speculative investments — irrespective of whether only one enterprise’s stock, specialized index resources, or cryptocurrency alone — to under 5% of your respective full investing portfolio.

Investing in Corporations with Crypto Passions

That’s how own finance expert Suze Orman initially did it. She recently informed NextAdvisor about how she invested in MicroStrategy, a cloud computing agency that retains billions in Bitcoin, for the reason that its CEO was putting all of the corporation’s Doing the job money into Bitcoin. She figured if Bitcoin increased in worth, so would the value of Microstrategy’s inventory.

But as anybody who follows Orman’s suggestions is familiar with, she recommends index money like a a lot better financial commitment technique than finding specific shares.

In lieu of purchasing shares in almost any solitary crypto-forward organization, it’s improved to keep up a balanced portfolio by pinpointing firms with crypto passions, and making sure their shares are included in any index or mutual cash you put cash into. Not merely does that enable you to invest in the companies in which you see possible, but Furthermore, it allows you keep your investments diversified in a broader fund.

When you invest with Vanguard, for instance, You may use the positioning’s Keeping look for to find many of the Vanguard money which include a selected corporation. Just enter the organization’s ticker image (like TSLA for Tesla) as well as the Resource will present a summary of all of the Vanguard items that have holdings of its shares. Other investing platforms present very similar techniques to go looking by company inside of index and mutual cash.

But specialised ETFs or mutual funds may feature larger service fees than complete marketplace indexes, so pay attention to exactly how much you’re going to be charged for buying shares. Schneider considers an expenditure ratio (That which you fork out in service fees) underneath 0.two% being quite lower, and anything at all around one% to generally be very highly-priced. For an presently speculative financial commitment, higher costs can hinder your progress much more.

Here are a few extra examples of publicly-traded providers which can be introducing Bitcoin or blockchain technology to their company. These are definitely absolutely not the only real companies concerned, and more are signing up for the listing every day. (Circle, a digital payment System specializing in crypto payments, for example, just announced its meant IPO):

MicroStrategy (MSTR)

MicroStrategy offers business enterprise intelligence and cloud companies, and invests its belongings into Bitcoin.

Marathon Digital Holdings (MARA)

Marathon Electronic Holdings aims to become the most important bitcoin mining Procedure in North The us.

RIOT Blockchain (RIOT)

Riot Blockchain is usually a Bitcoin mining firm.

Bitfarms (BITF)

Bitfarms operates blockchain computing facilities.

Galaxy Digital (BRPHF)

Galaxy Electronic is really a broker-supplier involved with crypto expense management, buying and selling, custody, and mining.

Tesla (TSLA)

Tesla’s founder Elon Musk, is really a proponent of cryptocurrency, and the corporation retains about a billion pounds value of Bitcoin. It temporarily accepted Bitcoin payments in early 2021 prior to ending This system, but Musk recently stated Tesla will “almost certainly” restart Bitcoin payments.

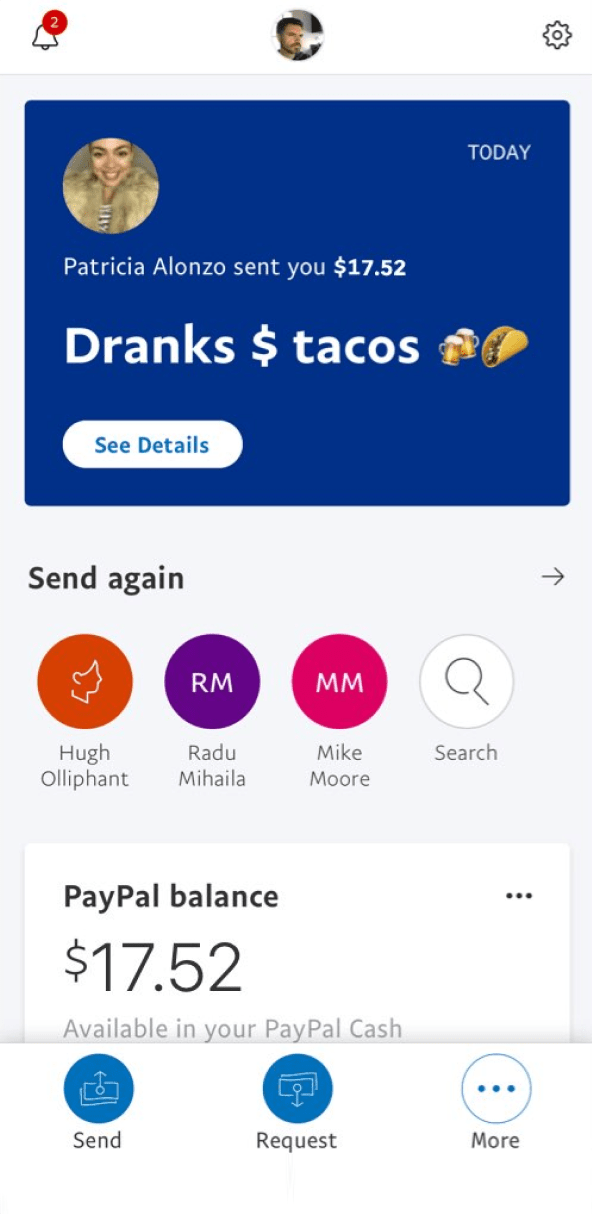

PayPal (PYPL)

PayPal is really a payment System where by people should buy cryptocurrency.

Square (SQ)

Sq. recently announced that It will be entering the decentralized finance Place.

Coinbase (COIN)

Coinbase is the very first community cryptocurrency Trade. It debuted over the Nasdaq in spring 2021.

Blockchain ETFs

ETFs — exchange traded resources — work similar to a hybrid concerning mutual resources and stocks. An ETF is actually a group of shares, bonds or other assets. Whenever you purchase a share of an ETF, there is a stake during the basket of investments owned through the fund.

Although many ETFs — such as complete sector ETFs — have very small cost ratios, specialised ETFs may be nearer to your 1% ratio that Schneider would take into account very pricey. This will make fewer of an influence if more expensive ETFs comprise a little part of your Over-all portfolio, keep in mind the cost when considering options.

ETFs in many cases are grouped by what kind of investments they maintain, so A technique you can indirectly invest in cryptocurrency is by Placing funds into an ETF centered on its fundamental engineering: blockchain. A blockchain ETF will involve providers both utilizing or establishing blockchain technologies.

Many people who are skeptical about cryptocurrency but have confidence in the “transformative” blockchain technologies guiding it see blockchain ETFs as a much more audio financial commitment.

It’s similar to the California gold rush of your 1800s, claims Chris Chen, CFP, of Insight Financial Strategists in Newton, Massachusetts, for just a the latest NextAdvisor Tale about blockchain technological innovation: “Lots of men and women rushed in there to dig for gold, and A lot of them never ever built any dollars,” he claimed. “The oldsters who manufactured the money are those that sold the shovels. The businesses which are supporting the event of blockchain are classified as the shovel sellers.”

ETFs are created by different companies, however , you can https://en.search.wordpress.com/?src=organic&q=Puppy Crypto normally buy them as a result of whichever brokerage you typically use to take a position. Just like you could research your brokerage for personal stocks, You can even try to find money utilizing the symbols related to them. Here are some blockchain ETFs available to traders (with listings on popular brokerages like Fidelity, Vanguard, and Charles Schwab):

BLOK (Amplify Transformational Information Sharing ETF)

BLOK is the biggest blockchain ETF by total belongings. It’s biggest holdings are Puppies PayPal, MicroStrategy, and Sq..

BLCN (Siren Nasdaq NexGen Economic system ETF)

BLCN’s best holdings are Coinbase, Accenture, and Sq..

LEGR (Initially Rely on Indxx Innovative Transaction & System ETF)

LEGR’s top rated holdings are NVIDIA, Oracle, and Fujitsu.